Which Of The Following Transactions Is Most Likely To Increase The Current Ratio?

Analyzing and Recording Transactions

xv Analyze Business organisation Transactions Using the Bookkeeping Equation and Testify the Impact of Business Transactions on Financial Statements

You lot gained a basic understanding of both the basic and expanded accounting equations, and looked at examples of assets, liabilities, and stockholder'south equity in Define and Examine the Expanded Accounting Equation and Its Relationship to Analyzing Transactions. At present, we can consider some of the transactions a business may encounter. Nosotros can review how each transaction would bear upon the basic accounting equation and the corresponding fiscal statements.

As discussed in Define and Examine the Initial Steps in the Accounting Cycle, the offset step in the accounting wheel is to identify and clarify transactions. Each original source must be evaluated for financial implications. Meaning, will the information independent on this original source bear upon the financial statements? If the answer is yes, the company will and then clarify the information for how it affects the financial statements. For example, if a company receives a cash payment from a client, the company needs to know how to record the cash payment in a meaningful fashion to keep its financial statements up to engagement.

Monetary Value of Transactions

You are the accountant for a small-scale computer programming company. You lot must record the following transactions. What values do you think you will use for each transaction?

- The company purchased a secondhand van to be used to travel to customers. The sellers told you they believe information technology is worth $12,500 but agreed to sell it to your company for $11,000. You believe the company got a actually skilful bargain because the van has a $13,000 Bluish Volume value.

- Your company purchased its part building five years ago for $175,000. Values of real estate have been rising quickly over the last five years, and a realtor told you the company could easily sell it for $250,000 today. Since the edifice is now worth $250,000, you are contemplating whether y'all should increase its value on the books to reflect this estimated electric current market value.

- Your company has performed a task for a customer. The customer agreed to a minimum price of $2,350 for the work, but if the customer has absolutely no issues with the programming for the first month, the client volition pay you $2,500 (which includes a bonus for work well washed). The possessor of the visitor is nigh 100% sure she will receive $2,500 for the job washed. You lot accept to record the acquirement earned and need to decide how much should be recorded.

- The possessor of the company believes the about valuable asset for his company is the employees. The service the company provides depends on having intelligent, hardworking, dependable employees who believe they need to deliver exactly what the customer wants in a reasonable amount of time. Without the employees, the visitor would not exist so successful. The owner wants to know if she can include the value of her employees on the residue sheet every bit an nugget.

Solution

- The van must be recorded on the books at $11,000 per the cost principle. That is the price that was agreed to between a willing buyer and seller.

- The cost principle states that you must record an asset on the books for the price you bought it for and so get out it on the books at that value unless there is a specific rule to the contrary. The visitor purchased the edifice for $175,000. Information technology must stay on the books at $175,000. Companies are not allowed to increase the value of an asset on their books just because they believe information technology is worth more than.

- Y'all must tape the revenue at $2,350 per the rules of conservatism. We do not want to record acquirement at $2,500 when nosotros are not absolutely 100% sure that is what nosotros will earn. Recording information technology at $2,500 might mislead our statement users to remember we have earned more revenue than we actually have.

- Even though the employees are a wonderful asset for the visitor, they cannot exist included on the balance canvass as an asset. There is no way to assign a monetary value in US dollars to our employees. Therefore, we cannot include them in our assets.

Reviewing and Analyzing Transactions

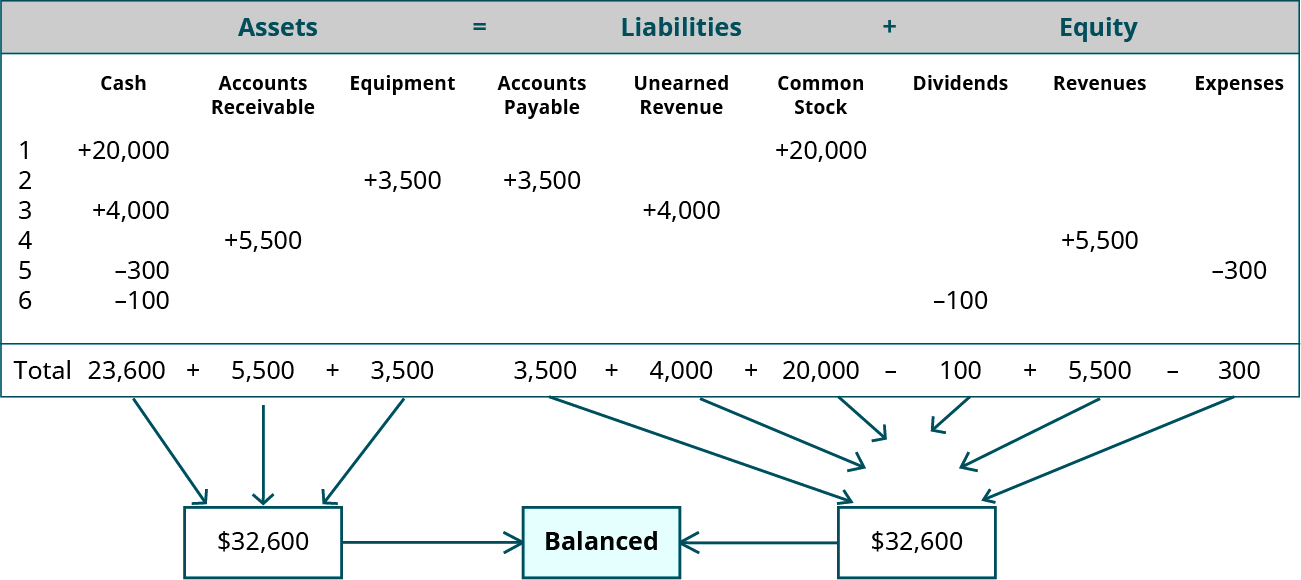

Let usa assume our business is a service-based visitor. We use Lynn Sanders' pocket-sized printing visitor, Printing Plus, as our case. Please notice that since Printing Plus is a corporation, we are using the Mutual Stock account, instead of Owner's Disinterestedness. The post-obit are several transactions from this business's current month:

- Issues $20,000 shares of mutual stock for cash.

- Purchases equipment on account for $3,500, payment due within the month.

- Receives $4,000 cash in advance from a client for services non nonetheless rendered.

- Provides $v,500 in services to a client who asks to exist billed for the services.

- Pays a $300 utility bill with cash.

- Distributed $100 cash in dividends to stockholders.

Nosotros now analyze each of these transactions, paying attention to how they impact the accounting equation and corresponding financial statements.

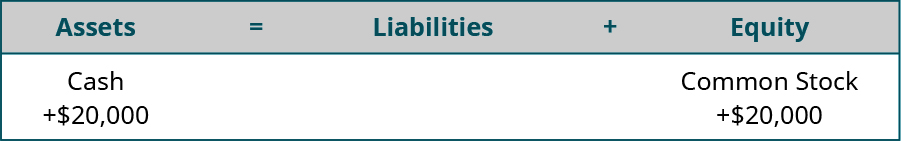

Transaction one: Issues $20,000 shares of common stock for greenbacks.

Analysis: Looking at the accounting equation, we know cash is an asset and common stock is stockholder's equity. When a visitor collects cash, this will increase avails because cash is coming into the business concern. When a company problems common stock, this will increase a stockholder'southward disinterestedness because he or she is receiving investments from owners.

Remember that the accounting equation must remain balanced, and assets need to equal liabilities plus equity. On the nugget side of the equation, we show an increment of $20,000. On the liabilities and disinterestedness side of the equation, there is also an increase of $20,000, keeping the equation balanced. Changes to avails, specifically greenbacks, will increase avails on the residue sheet and increase cash on the argument of greenbacks flows. Changes to stockholder's disinterestedness, specifically common stock, will increase stockholder'due south equity on the balance sheet.

Transaction 2: Purchases equipment on account for $3,500, payment due within the calendar month.

Assay: We know that the company purchased equipment, which is an asset. Nosotros likewise know that the company purchased the equipment on account, meaning it did not pay for the equipment immediately and asked for payment to be billed instead and paid subsequently. Since the company owes money and has not notwithstanding paid, this is a liability, specifically labeled every bit accounts payable. There is an increase to assets considering the company has equipment it did not have before. At that place is also an increase to liabilities because the company now owes money. The more coin the visitor owes, the more that liability volition increase.

The bookkeeping equation remains balanced because there is a $3,500 increment on the nugget side, and a $3,500 increase on the liability and equity side. This modify to avails volition increase assets on the balance sail. The change to liabilities volition increment liabilities on the remainder sheet.

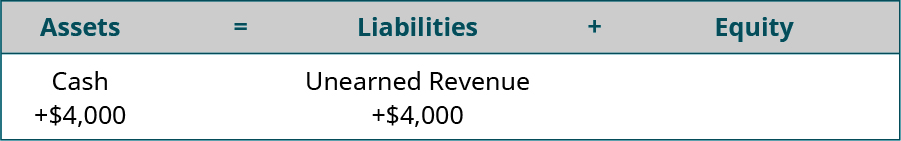

Transaction three: Receives $4,000 cash in advance from a client for services non yet rendered.

Analysis: We know that the visitor nerveless greenbacks, which is an nugget. This collection of $4,000 increases avails considering money is coming into the business organization.

The visitor has however to provide the service. According to the revenue recognition principle, the company cannot recognize that revenue until it provides the service. Therefore, the company has a liability to the client to provide the service and must tape the liability every bit unearned acquirement. The liability of $4,000 worth of services increases considering the company has more unearned revenue than previously.

The equation remains balanced, as assets and liabilities increase. The balance sail would experience an increase in assets and an increment in liabilities.

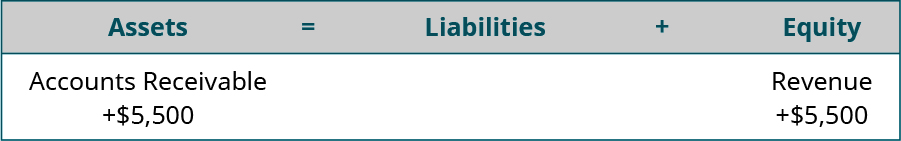

Transaction iv: Provides $5,500 in services to a customer who asks to be billed for the services.

Analysis: The customer asked to be billed for the service, pregnant the customer did not pay with cash immediately. The customer owes money and has non yet paid, signaling an accounts receivable. Accounts receivable is an asset that is increasing in this example. This customer obligation of $5,500 adds to the balance in accounts receivable.

The visitor did provide the services. As a outcome, the revenue recognition principle requires recognition every bit revenue, which increases equity for $5,500. The increase to assets would exist reflected on the balance sail. The increase to equity would impact three statements. The income statement would see an increment to revenues, changing internet income (loss). Internet income (loss) is computed into retained earnings on the statement of retained earnings. This change to retained earnings is shown on the balance sheet under stockholder'due south equity.

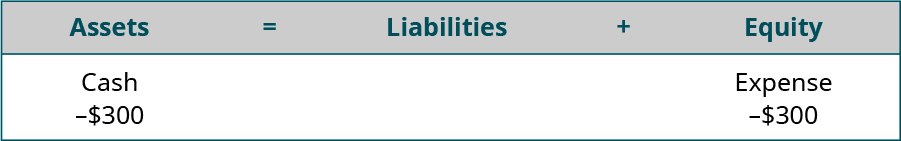

Transaction five: Pays a $300 utility bill with greenbacks.

Analysis: The visitor paid with greenbacks, an asset. Assets are decreasing past $300 since cash was used to pay for this utility bill. The company no longer has that money.

Utility payments are generated from bills for services that were used and paid for within the bookkeeping period, thus recognized as an expense. The expense decreases equity by $300. The decrease to assets, specifically cash, affects the residuum sail and argument of cash flows. The subtract to disinterestedness equally a result of the expense affects 3 statements. The income argument would see a change to expenses, changing net income (loss). Internet income (loss) is computed into retained earnings on the statement of retained earnings. This change to retained earnings is shown on the balance sail under stockholder'due south equity.

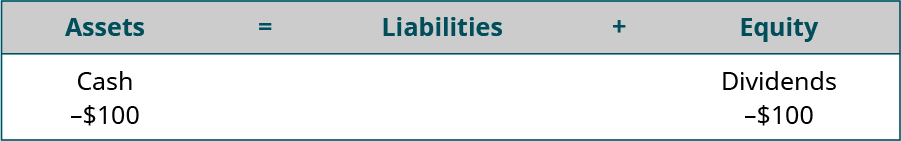

Transaction 6: Distributed $100 cash in dividends to stockholders.

Assay: The company paid the distribution with cash, an asset. Assets decrease past $100 equally a outcome. Dividends affect equity and, in this instance, decrease equity by $100. The decrease to avails, specifically cash, affects the balance sheet and argument of cash flows. The decrease to equity because of the dividend payout affects the statement of retained earnings by reducing ending retained earnings, and the balance sheet past reducing stockholder's equity.

Let's summarize the transactions and make sure the bookkeeping equation has remained balanced. Shown are each of the transactions.

As you lot can run into, assets total $32,600, while liabilities added to equity also equal $32,600. Our accounting equation remains counterbalanced. In Use Periodical Entries to Record Transactions and Mail to T-Accounts, we add together other elements to the accounting equation and expand the equation to include private revenue and expense accounts.

Debbie's Dairy Subcontract

Debbie's Dairy Farm had the following transactions:

- Debbie ordered shelving worth $750.

- Debbie's selling price on a gallon of milk is $3.00. She finds out that most local stores are charging $iii.50. Based on this information, she decides to increase her price to $3.25. She has an employee put a new price sticker on each gallon.

- A customer buys a gallon of milk paying cash.

- The shelving is delivered with an invoice for $750.

Which events volition be recorded in the accounting system?

Solution

- Debbie did not even so receive the shelving—it has only been ordered. As of now there is no new asset owned past the company. Since the shelving has not notwithstanding been delivered, Debbie does not owe any money to the other visitor. Debbie will not record the transaction.

- Irresolute prices does non accept an impact on the visitor at the fourth dimension the price is inverse. All that happened was that a new price sticker was placed on the milk. Debbie still has all the milk and has not received any money. Debbie will not record the transaction.

- Debbie now has a transaction to record. She has received cash and the customer has taken some of her inventory of milk. She has an increase in one asset (cash) and a decrease in some other nugget (inventory.) She also has earned revenue.

- Debbie has taken possession of the shelving and is the legal owner. She besides has an increase in her liabilities every bit she accustomed delivery of the shelving merely has not paid for information technology. Debbie will record this transaction.

Key Concepts and Summary

- Both the bones and the expanded accounting equations are useful in analyzing how any transaction affects a visitor'south financial statements.

Multiple Choice

(Figure)Which of these events will not exist recognized?

- A service is performed, but the payment is not nerveless on the same day.

- Supplies are purchased. They are non paid for; the company will be billed.

- A copy machine is ordered. It will be delivered in two weeks.

- Electricity has been used but has non been paid for.

(Effigy)A company purchased a building 20 years ago for $150,000. The building currently has an appraised market value of $235,000. The company reports the edifice on its residual sail at $235,000. What concept or principle has been violated?

- split entity concept

- recognition principle

- monetary measurement concept

- cost principle

(Figure)What is the impact on the bookkeeping equation when a current month's utility expense is paid?

- both sides increment

- both sides decrease

- simply the Asset side changes

- neither side changes

(Effigy)What is the impact on the bookkeeping equation when a payment of business relationship payable is fabricated?

- both sides increment

- both sides decrease

- only the Nugget side changes

- neither side changes

(Figure)What is the impact on the bookkeeping equation when an accounts receivable is collected?

- both sides increase

- both sides decrease

- merely the Asset side changes

- the total of neither side changes

(Figure)What is the impact on the accounting equation when a auction occurs?

- both sides increase

- both sides subtract

- only the Asset side changes

- neither side changes

(Figure)What is the impact on the bookkeeping equation when stock is issued, in substitution for avails?

- both sides increase

- both sides decrease

- just the Nugget side changes

- neither side changes

Questions

(Effigy)What is the effect on the bookkeeping equation when a business purchases supplies on account?

(Figure)What is the effect on the accounting equation when a business pays the balance due on accounts payable?

Decreasing cash decreases assets; decreasing accounts payable decreases liabilities. Avails (decrease) = Liabilities (decrease) + Equity (no change).

(Figure)Is it still necessary to record a transaction if it has no net effect on the accounting equation? Explain your answer.

(Figure)Why does the combined total of the visitor'due south liabilities and equity always equal the total of the company's assets?

The combined total of liabilities and equity equals the total of assets considering there is a merits against every nugget that the visitor owns. Creditors have claims confronting some of the company'south avails, in the amount of the liabilities owed to them; owners (stockholders) have claims confronting all the rest of the company's avails. Equity is the total of assets minus liabilities, which is sometimes referred to equally net assets.

Practice Set up A

(Figure)Bespeak what impact the post-obit transactions would have on the bookkeeping equation, Assets = Liabilities + Disinterestedness.

| Bear upon i | Bear upon two | ||

|---|---|---|---|

| A. | Received greenbacks from issuance of common stock | ||

| B. | Sold appurtenances to customers on account | ||

| C. | Collected cash from customer sales made in previous month | ||

| D. | Paid cash to vendors for supplies delivered last month | ||

| Eastward. | Purchased inventory on account | ||

(Effigy)For the following accounts please point whether the normal residue is a debit or a credit.

- Sales

- Dividends

- Office Supplies

- Retained Earnings

- Accounts Receivable

- Prepaid Rent

- Prepaid Insurance

- Wages Payable

- Building

- Wages Expense

(Figure)Signal what impact the post-obit transactions would have on the accounting equation, Assets = Liabilities + Disinterestedness.

| Impact ane | Touch 2 | ||

|---|---|---|---|

| A. | Paid monthly note payment to bank | ||

| B. | Sold inventory on account | ||

| C. | Bought supplies, to exist paid for next month | ||

| D. | Received cash from sales this calendar month | ||

| E. | Paid for inventory purchased on account last month | ||

(Effigy)Identify the normal balance for each of the following accounts. Choose Dr for Debit; Cr for Credit.

| Normal balance | ||

|---|---|---|

| A. | Utilities Expense | |

| B. | Greenbacks | |

| C. | Equipment | |

| D. | Rent Revenue | |

| E. | Preferred Stock | |

| F. | Interest Payable | |

(Figure)Identify whether each of the following transactions would be recorded with a debit (Dr) or credit (Cr) entry.

| Debit or credit? | ||

|---|---|---|

| A. | Cash increase | |

| B. | Supplies subtract | |

| C. | Accounts Payable increase | |

| D. | Common Stock decrease | |

| East. | Involvement Payable subtract | |

| F. | Notes Payable decrease | |

(Figure)Identify whether each of the post-obit transactions would be recorded with a debit (Dr) or credit (Cr) entry.

| Debit or credit? | ||

|---|---|---|

| A. | Equipment decrease | |

| B. | Common Stock Sold increase | |

| C. | Gas and Oil Expense increase | |

| D. | Service revenue decrease | |

| E. | Miscellaneous Expense decrease | |

| F. | Bonds Payable decrease | |

(Effigy)Identify whether ongoing transactions posted to the following accounts would normally take only debit entries (Dr), merely credit entries (Cr), or both debit and credit entries (both).

| Type of entry | ||

|---|---|---|

| A. | Accounts Payable | |

| B. | Cash | |

| C. | Gas and Oil Expense | |

| D. | Rent Revenue | |

| E. | Supplies Expense | |

| F. | Common Stock | |

Exercise Ready B

(Figure)Indicate what touch the following transactions would have on the bookkeeping equation, Assets = Liabilities + Equity.

| Touch on 1 | Affect ii | ||

|---|---|---|---|

| A. | Paid this month's utility bill | ||

| B. | Purchased supplies for greenbacks | ||

| C. | Received greenbacks for services performed | ||

| D. | Collected cash from customer accounts receivable | ||

| E. | Paid creditors on account | ||

(Figure)For the following accounts indicate whether the normal residuum is a debit or a credit.

- Unearned Revenue

- Interest Expense

- Rent Expense

- Rent Revenue

- Accounts Payable

- Greenbacks

- Supplies

- Accounts Payable

- Equipment

- Utilities Expense

(Effigy)Which two accounts are affected by each of the following transactions?

| Account 1 | Account two | ||

|---|---|---|---|

| A. | Received cash from issuance of common stock | ||

| B. | Purchased country past issuing a note payable | ||

| C. | Paid remainder on account for last month'southward inventory purchases | ||

| D. | Received greenbacks from customers for this month's sales | ||

| E. | Sold trade to customers on account | ||

(Figure)Identify the normal balance for each of the following accounts. Cull Dr for Debit; Cr for Credit.

| Normal rest | ||

|---|---|---|

| A. | Insurance Expense | |

| B. | Accounts Receivable | |

| C. | Office Supplies | |

| D. | Sales Acquirement | |

| E. | Common Stock | |

| F. | Notes Payable | |

(Figure)Identify whether each of the following transactions would be recorded with a debit (Dr) or credit (Cr) entry.

| Debit or credit? | ||

|---|---|---|

| A. | Greenbacks decrease | |

| B. | Supplies increment | |

| C. | Accounts Payable decrease | |

| D. | Common Stock increment | |

| E. | Accounts Payable increase | |

| F. | Notes Payable increment | |

(Figure)Identify whether each of the post-obit transactions would be recorded with a debit (Dr) or credit (Cr) entry.

| Debit or credit? | ||

|---|---|---|

| A. | Equipment increase | |

| B. | Dividends Paid increase | |

| C. | Repairs Expense increase | |

| D. | Service revenue increase | |

| E. | Miscellaneous Expense increase | |

| F. | Bonds Payable increment | |

(Figure)Identify whether ongoing transactions posted to the following accounts would ordinarily have only debit entries (Dr), merely credit entries (Cr), or both debit and credit entries (both).

| Type of entry | ||

|---|---|---|

| A. | Notes Payable | |

| B. | Accounts Receivable | |

| C. | Utilities Expense | |

| D. | Sales Revenue | |

| E. | Insurance Expense | |

| F. | Dividends | |

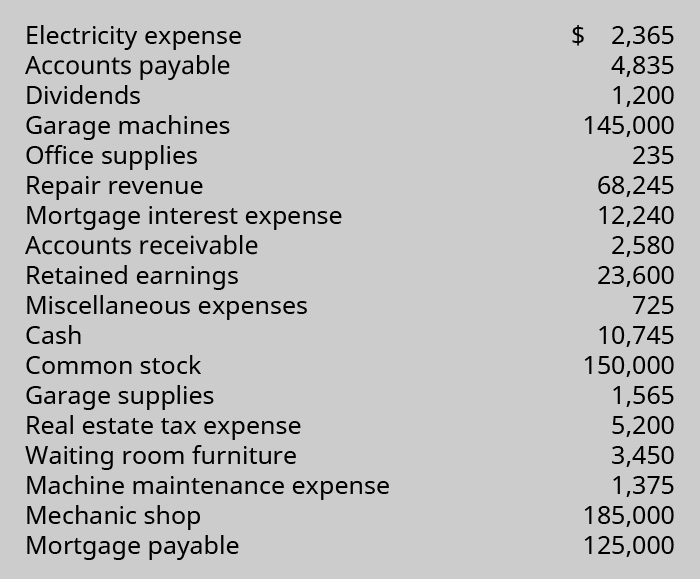

(Figure)(Figure)Westward End Inc., an automobile mechanic shop, has the following account balances, given in no certain social club, for the quarter concluded March 31, 2022. Based on the information provided, set up West End'southward annual financial statements (omit the Statement of Greenbacks Flows).

Prepare West End's almanac fiscal statements. (Omit the Statement of Cash Flows.)

Trouble Set A

(Figure)(Figure)Identify the financial argument on which each of the following account categories would appear: the residue sheet (BS), the income statement (IS), or the retained earnings statement (RE). Indicate the normal balance (Dr for debit; Cr for credit) for each account category.

| Financial statement | Normal residue | |

|---|---|---|

| Assets | ||

| Common stock | ||

| Dividends | ||

| Expenses | ||

| Liabilities | ||

| Revenue | ||

(Figure)Indicate what impact (+ for increase; – for decrease) the following transactions would have on the accounting equation, Avails = Liabilities + Equity.

| Bear upon 1 | Touch on 2 | ||

|---|---|---|---|

| A. | Issued stock for cash | ||

| B. | Purchased supplies on business relationship | ||

| C. | Paid employee salaries | ||

| D. | Paid note payment to bank | ||

| East. | Collected rest on accounts receivable | ||

(Effigy)Betoken how changes in the following types of accounts would be recorded (Dr for debit; Cr for credit).

| Increment | Decrease | ||

|---|---|---|---|

| A. | Nugget accounts | ||

| B. | Liability accounts | ||

| C. | Mutual stock | ||

| D. | Revenue | ||

| East. | Expense | ||

(Figure)Identify the normal balance (Dr for Debit; Cr for Credit) and type of business relationship (A for asset, 50 for liability, Eastward for equity, E-rev for revenue, E-exp for expense, and E-eq for equity) for each of the post-obit items.

| Normal balance | Account type | ||

|---|---|---|---|

| A. | Accounts Payable | ||

| B. | Supplies | ||

| C. | Inventory | ||

| D. | Common Stock | ||

| E. | Dividends | ||

| F. | Salaries Expense | ||

(Effigy)Indicate the net effect (+ for increase; – for decrease; 0 for no upshot) of each of the post-obit transactions on each part of the accounting equation, Assets = Liabilities + Equity. For example, for payment of an accounts payable remainder, A (–) = L (–) + E (0).

- sale of trade to client on account

- payment on notation payable

- purchase of equipment for greenbacks

- collection of accounts receivable

- purchase of supplies on business relationship

(Figure)Identify whether the following transactions would be recorded with a debit (Dr) or credit (Cr) entry. Indicate the normal balance of the account.

| Transaction | Debit or credit? | Normal balance | |

|---|---|---|---|

| A. | Equipment increase | ||

| B. | Dividends Paid increase | ||

| C. | Repairs Expense increment | ||

| D. | Service acquirement subtract | ||

| Eastward. | Miscellaneous Expense increase | ||

| F. | Bonds Payable decrease | ||

Trouble Set B

(Effigy)(Figure)Identify the fiscal statement on which each of the following account categories would announced: the rest sheet (BS), the income statement (IS), or the retained earnings statement (RE).

| Financial statement | Normal balance | |

|---|---|---|

| Accounts Receivable | ||

| Motorcar Expense | ||

| Cash | ||

| Equipment | ||

| Notes Payable | ||

| Service Revenue | ||

(Figure)Bespeak what impact (+ for increment; – for decrease) the following transactions would take on the accounting equation, Avails = Liabilities + Disinterestedness.

| Transaction | Impact 1 | Affect two | |

|---|---|---|---|

| A. | Paid balance due for accounts payable | ||

| B. | Charged clients for legal services provided | ||

| C. | Purchased supplies on account | ||

| D. | Collected legal service fees from clients for current calendar month | ||

| Due east. | Issued stock in exchange for a note receivable | ||

(Figure)Indicate how changes in these types of accounts would be recorded (Dr for debit; Cr for credit).

| Debit or credit? | ||

|---|---|---|

| A. | Asset accounts | |

| B. | Liability accounts | |

| C. | Mutual Stock | |

| D. | Acquirement | |

| Due east. | Expense | |

(Figure)Place the normal balance (Dr for Debit; Cr for Credit) and type of account (A for nugget, Fifty for liability, Due east for disinterestedness, E-rev for revenue, E-exp for expense, and E-eq for disinterestedness) for each of the following accounts.

| Normal balance | Account type | ||

|---|---|---|---|

| A. | Utility Expense | ||

| B. | Accounts Receivable | ||

| C. | Interest Revenue | ||

| D. | Retained Earnings | ||

| Eastward. | Land | ||

| F. | Sales Acquirement | ||

(Effigy)Indicate the net result (+ for increase; – for decrease; 0 for no effect) of each of the post-obit transactions on each part of the accounting equation, Assets = Liabilities + Equity. For example, for payment of an accounts payable balance, A (–) = Fifty (–) + E (0).

- Payment of main balance of note payable

- Buy of supplies for cash

- Payment of dividends to stockholders

- Issuance of stock for cash

- Billing customer for physician services provided

Thought Provokers

(Figure)Visit the website of the SEC (https://www.sec.gov/edgar/searchedgar/companysearch.html). Search for the latest Form ten-Grand for a company you would similar to analyze. Submit a short memo that

- Includes the proper name and ticker symbol of the company you have chosen

- Reviews the company's comparative Rest Sheet to gather the following information:

- Compare beginning and catastrophe Assets totals, noting corporeality of change for the about recent menstruation

- Compare beginning and ending Liabilities totals, noting corporeality of modify for the nigh recent period

- Compare beginning and ending Equity totals, noting corporeality of change for the well-nigh recent period

- State the changes identified in (A), (B), and (C) in accounting equation format. If the "change" equation does non residual, explain why not. Hint: Double-check your calculations, and if the accounting equation modify still does non balance, search for notes in the company's files about prior period adjustments, which volition often explain why balances may differ.

- Provide the spider web link to the visitor'due south Form 10-Yard to permit accurate verification of your answers.

Which Of The Following Transactions Is Most Likely To Increase The Current Ratio?,

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/analyze-business-transactions-using-the-accounting-equation-and-show-the-impact-of-business-transactions-on-financial-statements/

Posted by: frostsealords.blogspot.com

0 Response to "Which Of The Following Transactions Is Most Likely To Increase The Current Ratio?"

Post a Comment